Talking of investments, we can categorise investment assets into 2 main classes. Real assets and Financial assets. Real assets are like physical gold, real estate, etc. while financial assets are like equity shares, mutual funds, etc. Real assets have their own values while financial assets derive their value from some collateral. From the current experience of lockdown and distancing its time to look at other classification of assets. Electronic assets and Physical assets. All those assets which can be bought and sold electronically are electronic assets while those which cannot be bought and sold electronically are physical assets. As compared to physical assets the electronic assets offer us much organized and liquid markets which are global. You may find it difficult to sell a piece of gold in current situation with markets shut all around but that is not the case with electronic gold. With globalized markets a buyer sitting in any part of the world may find value in our electronic asset and may buy it. It is not the case with physical asset as its buying and selling is limited to a certain local area. Physical assets consume much time, money and efforts to be sold.

Looking at the current situation full of uncertainty it may be so that you may not find a buyer for your physical asset. It may be so that the market might be shut or by selling the asset you may get corona from buyer for free.

So, the time has come where we not only change our living habits but also our financial habits. Invest in only those assets which are electronic. Even a fixed deposit. Consider a fixed deposit placed with bank by filling physical form with no online access. You may have Debit card / ATM but to liquidate the fixed deposit you have to visit the bank. Now consider a fixed deposit you had placed electronically. You can liquidate it with just few clicks. We have to change our financial habits the following way:

- Don’t be dependent on visiting bank for every work. Go digital.

- Stop buying insurance online on your own from portals. Buy insurance from reliable insurance agents and make your family a part of your insurance purchase decision. There have been instances where the insured had insurance purchased from online portal with few clicks but family was helpless as they had no details of it and there was no one to stand by their side at the time of need.

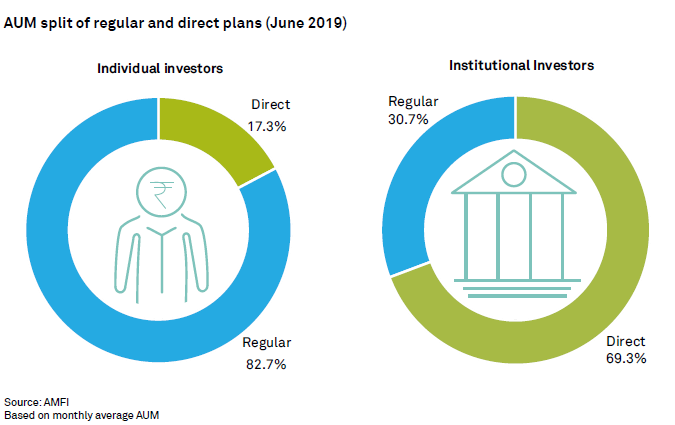

- Always have a financial advisor. Let him know your financial position and your insurance details. Make your family members familiar to him so that in the time of an emergency, he can guide your loved ones.

- Don’t purchase physical assets for investment purpose. Invest in electronic assets only so that you can sell them easily.

- You should purchase a medical insurance for your family. Medical insurance has to be sufficient. One must have at least Rs. 5,00,000 family floater for 3-4 members.

- If you are paying housing loan, have an insurance cover of an amount sufficient to cover your housing EMI’s. Remember if anything happens to you, your EMI payment obligations are transferred to your legal heirs.

- Have an emergency fund to get you going for at least 6 months without income.

Remember, with damage we have done to the nature, this is just the beginning of a new era where we will have to change for a better tomorrow; be it our lifestyle or our habits of handling finances.